When those diagnosed with life-threatening illnesses are asked by their doctors to make lifestyle modifications, only 9% make changes.1 They find it too hard to change even when they know it’s good for them. Likewise, many people may resist change, especially when that change could affect where they’ll live as they age.

Why Your Clients Like to Age in Place

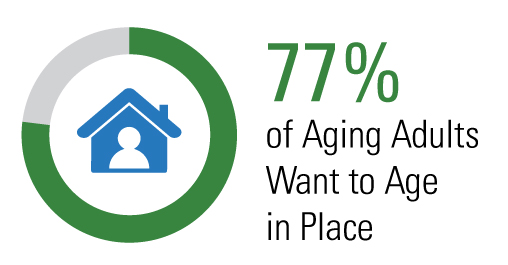

For aging adults 50+, 77% plan to age in their homes.2 Why? We’re comfortable in our homes. We like the routines, privacy, and freedom that come with homeownership. At home, we don’t have to ask if we’re allowed to have a dog or a cat. We enjoy having lots of space to spend time with friends and family. We don’t like the thought of being crammed into a small living place and having to get rid of lots of our stuff. And those of us who like to cook would be disappointed having to do it exclusively with a microwave.

Many people are confident in their ability to age in place. They don’t feel they’ll need support because they see themselves as younger than they are. A 2009 Pew Research study found that 60% of adults 65 and older say they feel younger than their age. Of those surveyed between the ages 65 of 74, a third say they feel 10 to 19 years younger than their age.3 As a result, people in their 40s, 50s, and even 60s can find it hard to anticipate the physical ailments ahead. This mindset can push the thought of someday moving to an assisted living community or nursing home off the table.

We Feel Young—Of Course We Can Age In Our Homes

Source: Despite Pandemic, Percentage of Older Adults Who Want to Age in Place Stays Steady, AARP, 11/21/22. Most recent data available.

The Health Risk of Aging in Place

Since most homes weren’t built for aging people, aging in place can increase health risks. As people age into their 70s, 80s, and 90s, their risk of falls, and resulting injuries, in their homes increases. One in four people over age 65 falls each year.4 More than 300,000 people are hospitalized each year from broken hips, and 95% of these fractures are a result of a fall.4 Most of these falls occur in the home for a variety of reasons, including clutter, loose rugs, limited access to railings and grab bars, or poor lighting. A broken hip can force people to consider moving to an assisted living facility.

The Social Risks of Aging in Place

As people age and stay in their homes well into their 80s or 90s, their mobility and access to transportation might decrease. This can mean fewer outings for social activities, which could lead to feelings of isolation. Isolation and loneliness can have serious health effects, even speeding up the aging process. In a six-year study, the loneliest participants were almost twice as likely to pass away compared to the least lonely ones.5

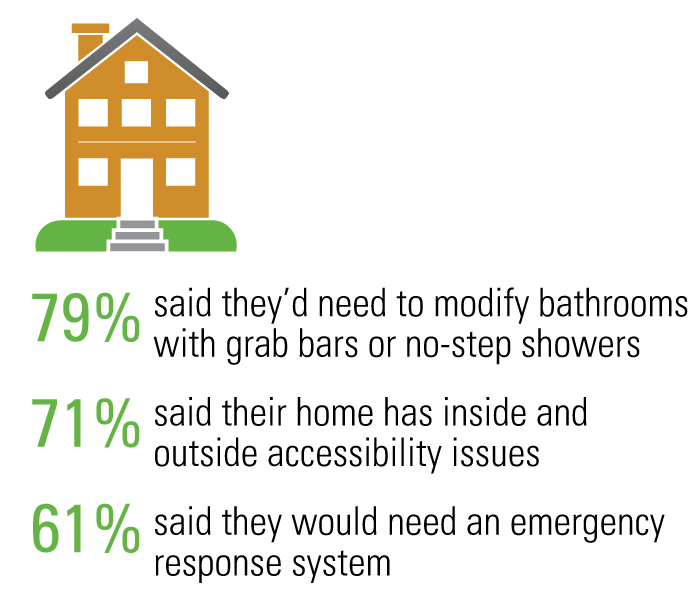

Our Homes Aren’t Ready for Aging in Place

For people with no mortgage (or a low mortgage) and enough income to cover expenses, aging in place might seem like a no-brainer. But we need to think farther into the future and evaluate if our homes will be a good place to live as we age.

An AARP study found that one third of aging adults surveyed said they would need to make changes to stay at home comfortably and safely.3 The house that works today may not work as well in the future. Home modifications may be needed. Not doing the necessary modifications could put you or a loved one at risk for an accident that could ultimately cost more than the modification, and could result in significant health issues.

Many Think They’re Homes Aren’t Age-Friendly

Source: Despite Pandemic, Percentage of Older Adults Who Want to Age in Place Stays Steady, AARP, 11/21/22. Most recent data available.

The Cost of Home Modifications

The cost of home modifications can get pricey. But, when compared to the cost of assisted living, they may be worth it. To get a better idea of the types and expense of home modifications you may need, meet with a certified aging-in-place specialist (CAPS). The CAPS program was developed by the National Association of Home Builders in collaboration with AARP. To find a CAPS professional near you, visit nahb.org/en/find/directory-designee.

The expense range of home modifications varies greatly. The number of modifications needed can depend on your needs. Basic modifications can cost up to $9,500,6 including installing:

- Grab bars

- Sturdy handrails along stairs

- Replacement rugs

- Better lighting

- Lever-handled doorknobs

More extensive modifications can cost up to $50,000 or more, including:6

- Removing (or reducing the height of) steps

- Widening hallways

- Adding a ramp

- Lowering cabinets

- Installing no-step showers

- Installing a generator to protect against power loss

For deeper insights on aging in place solutions, check out The Hartford’s Simple Steps to Stay Independent web page. You’ll find a consumer-friendly PDF called Simple Solutions: Practical Ideas and Products to Enhance Independent Living.

Since the range of expenses for home modification is so great, and the impact on the quality and safety of clients’ lives is significant, it makes sense to involve a CAPS professional to create a holistic aging-in-place plan.

If you’re remodeling your home, consider making age-friendly adjustments, such as widening doorways and corridors, eliminating walls to accommodate wheelchairs and scooters, or even creating space in a multistory home to add an elevator later. The additional costs during a remodel can only cost an average of 5%.7

The Cost of Aging in Place Support

As we age in our homes, at some point we may need help getting things done, e.g., housekeeping, laundry, heavy lifting, lawn care, gutter cleaning, grocery shopping, changing light bulbs, and air filters, and more. Fifty-two percent of those age 70 and older say that their health makes it hard for them to do home maintenance or repairs.8 We may be able to hire people to help with these activities.

Similar to home modifications, the cost of home-care support can vary. 70% of people turning age 65 will develop a severe long-term-care need in their lifetimes.9 The average annual cost of a homemaker is $68,640 assuming 44 hours of care per week.10 Homemaker service includes household tasks that people can’t complete on their own, including cleaning the house, cooking meals, or running errands. The average annual cost of a home health aide is $75,504.10 They offer more extensive personal care than family or friends can or have the time or resources to provide.

Can Support From Family and Friends Help Keep Costs Down?

Support and care provided by family can be cheaper. However, family members often pay the price. Many take time off from their careers or retire early, which on average costs caregivers $10,525.11 On average, caregivers pay $7,242 per year out of pocket for things like food, medication, and bills for their aging loved ones.11 The stress of caregiving on family members can lead to burnout. While family members might be willing at first, they might grow very tired of helping out over the years.

Low or no-cost support may be available. Try to find local social service agencies, senior centers, and private companies that can provide transportation and meals, either at a center or delivered to the home.

Discussing the Possibility of Assisted Living

There can come a point where we can’t care for ourselves, or it’s not safe for us to live in our homes. Then assisted living can be a good solution. Determining when that point comes is usually a family decision, but families tend to procrastinate on this decision. Fifty-four percent of people surveyed would rather have “the bird and the bees talk” with their kids than “the senior care” talk with their parents.12 Most people don’t like the idea of adult children trying to push them out of their homes and into assisted living.

While it’s not an easy topic to discuss, it’s better to discuss it sooner rather than later, when your options for insurance or care may be fewer and the costs may be higher.

Clients Really Don’t Like Discussing Eldercare With Their Parents

Source: How Senior Care Impacts Families Financially, Emotionally and in the Workplace, Care.com, 2016. Most recent data available used.

The Cost of Assisted Living

The average national annual cost of assisted living is $64,200, and a private room in a nursing home is $116,800.10 Assisted living facilities provide personal care and health services for people who may need assistance with activities of daily living (walking, feeding, dressing, toileting, bathing, and transferring). The level of care provided is not as extensive as that which may be provided in a nursing home. Nursing homes provide higher levels of supervision and care than in an assisted living facility. They offer personal care, room and board, supervision, medication, therapies, rehabilitation, and skilled nursing 24/7.

Each assisted living community has its own pricing model, but monthly costs typically cover:

- Taxes

- Insurance

- Utilities

- Repairs

- Appliance repair or replacement

- Meal plan

- Recreation and entertainment

- Fitness center

- Library

- Beauty salon/barbershop

- Craft workshop

- Scheduled transportation

Finding prices for assisted living can be challenging because of the complexity of individuals’ needs. It’s rare to find baseline pricing online. To get accurate pricing, you and your family should visit a community, get a full tour, talk with the residents, and then have a conversation with the facility staff about your needs and financial resources.

Health Advantages of Assisted Living

Assisted living communities are designed for mobility and accessibility while also offering expert care and medical attention if needed. Residents are served three meals a day that are tailored to the specific health needs of seniors. Maintenance is taken care of, so the risk of falls is reduced, e.g., there’s no need to climb up on a chair to change a light bulb.

The Social Advantages of Assisted Living

Assisted living offers socialization through planned activities and outings, such as field trips, dancing, and cultural events. Daily living in the common areas also offers fun and socialization for seniors. Plus, there’s a better chance to stay engaged living in a community of people of similar age dealing with similar issues.

To summarize, we’ve covered:

- Aging in place: Cost, social, and health impact

- Assisted living: Cost, social, and health impact

Plan for Change

Change is hard. However, taking action and making plans for tomorrow can make tomorrow easier. At some point, we’ll probably have to decide whether to age in place or move to an assisted living community. Some people will refuse to discuss the possibility of moving, while others will be more open. Consider discussing your options with a financial professional. They can help you anticipate your senior housing needs including, the health, cost, and social impacts of those decisions.

Next Steps:

- Download or order the client white paper

- Discuss senior housing options with your financial professional.

- Google search CAPS professionals and meet with one

Related Insight: Why We Need to Plan for 4 Retirements, Instead of 1

1 The neuroscience of change: Why it’s difficult and what makes it easier, Langley Group, 5/23/12. Most recent data available used.

2 Despite Pandemic, Percentage of Older Adults Who Want to Age in Place Stays Steady, AARP, 11/21/22. Most recent data available.

3 Growing Old in America: Expectations vs. Reality, Pew Research Center, 6/29/2009. Most recent data available.

4 Facts About Falls, CDC, 5/12/23

5 Does Being Lonely Make You Age Faster? AARP, 3/20/24

6 How much does it cost a remodel to adapt a home for aging in place?, Fixr, 8/17/22. Most recent data available.

7 6 Things You Must Know About Aging in Place, Kiplinger, 5/15. Most recent data available used.

8 Home Maintenance Among Homeowners Age 50+, The Hartford, 3/18. Most recent data available used.

9 100 Must-Know Statistics About Long-Term Care: 2023 Edition, Morningstar, 3/29/23

10 Compare Long Term Care Costs Across the United States, Genworth, 2023

11 Caregiving Can Be Costly — Even Financially, AARP, 6/21

12 How Senior Care Impacts Families Financially, Emotionally and in the Workplace, Care.com, 2016. Most recent data available used.

The information in this presentation is provided for informational purposes only. Hartford Mutual Funds may or may not be invested in the companies referenced herein; however, no endorsement of any product or service is being made. Hartford Funds is not associated with the entities referenced in this presentation.

Links from this paper to a non-Hartford Funds site are provided for users’ convenience only. Hartford Funds does not control or review these sites nor does the provision of any link imply an endorsement or association of such non-Hartford Fund sites. Hartford Funds is not responsible for and makes no representation or warranty regarding the contents, completeness or accuracy or security of any materials on such sites. If you decide to access such non-Hartford Funds sites, you do so at your own risk.