After many years of low interest rates, investors are finally getting attractive interest rates on their cash holdings. With a little searching, you can find money-market funds and one-year CDs that pay 4% or more. Loading up on cash may seem like a good strategy, but like your favorite dessert, is there a downside to having too much of a good thing?

Here are three reasons why investors should be careful about holding too much cash:

1. Cash has usually delivered negative returns after inflation and taxes

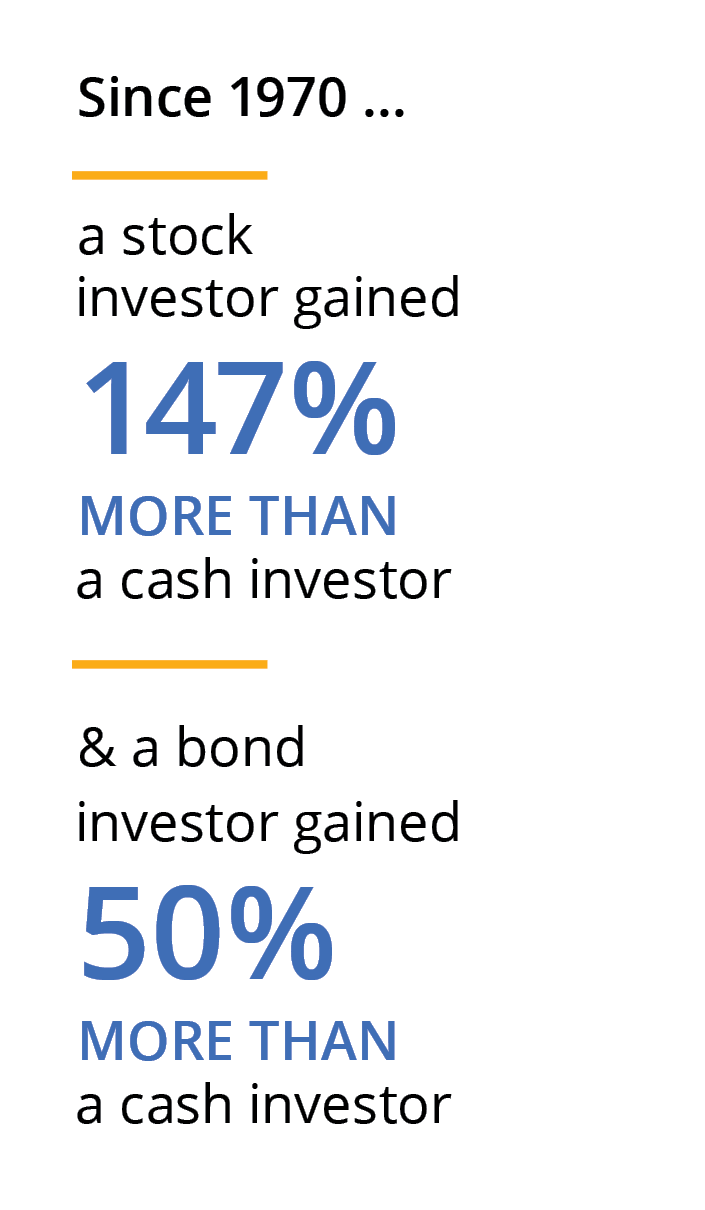

2. Cash hasn’t historically helped investors grow their wealth

3. Today’s attractive interest rates may not be available tomorrow

1. Cash Has Usually Delivered Negative Returns After Inflation and Taxes

Cash has a key role in every portfolio. Everyone needs cash on hand for recurring expenses such as mortgage payments, college tuition, and credit-card bills. It’s also prudent to have an emergency fund because life is unpredictable. But it’s important for investors to realize that cash investments such as CDs typically don’t generate a positive return after factoring in taxes and inflation (FIGURE 1). Even with a historically generous 12-month CD rate of 4.42%, the real after-tax return (i.e., the return after factoring in inflation and taxes) is still less than 1%.