If you’ve been working most of your life and have arrived at your sixth decade, congratulations: You’re entitled to collect what could potentially be thousands of dollars in annual Social Security benefits. And if you’re married and at least one of you has earned income, the news gets even better: One spouse will likely qualify for additional Social Security spousal benefits as well, providing couples with a strategy to potentially improve on what they might otherwise receive.

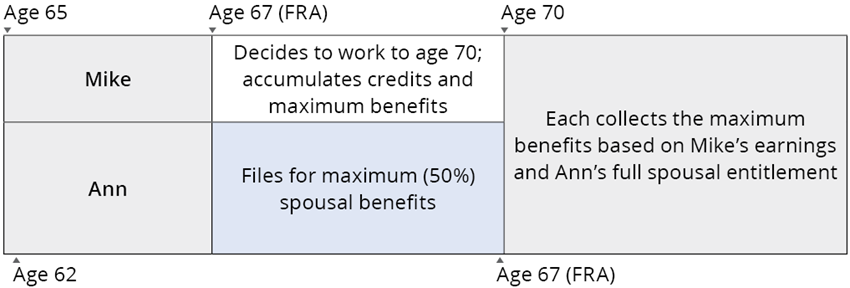

But the ins and outs of spousal benefits are complicated and frequently misunderstood. That’s too bad, because a spousal benefit, if you qualify, can potentially provide up to half of what your higher-earning spouse is entitled to collect.

Your Mileage May Vary

It sounds simple enough, but there’s a lot more to it. The strategy that works best for you ultimately depends on a host of factors, including: age differences, career earnings, level of savings, health status, and the date of your Social Security full-retirement age (also called: your FRA—see FIGURE 1).

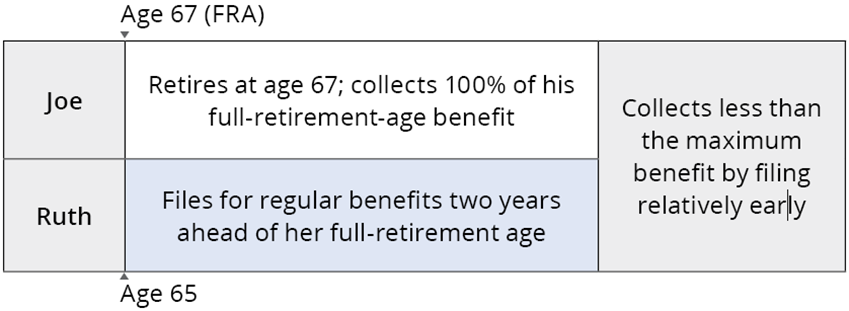

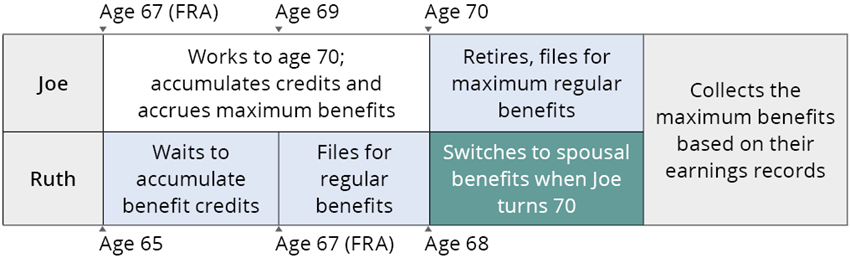

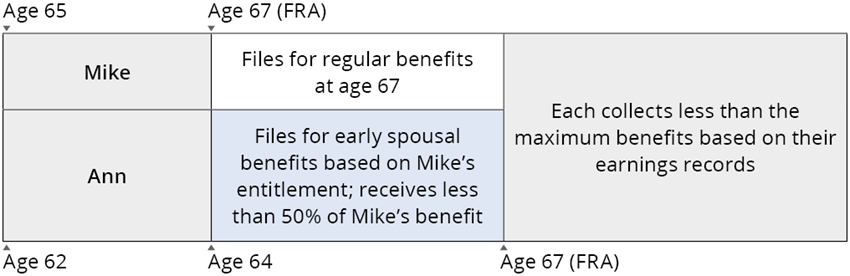

We’ll take a close look at three hypothetical couples—Joe and Ruth, Ann and Mike, and Norm and Karen—each approaching the claiming decision from different vantage points. But first, let’s review some of the basic Social Security rules that can impact whether some combination of regular benefits and spousal benefits may be right for you to consider.