Going through a separation can be one of the most difficult experiences for people at any age. But more and more, it’s how a growing number of retirement-age couples are beginning the next phase of life.

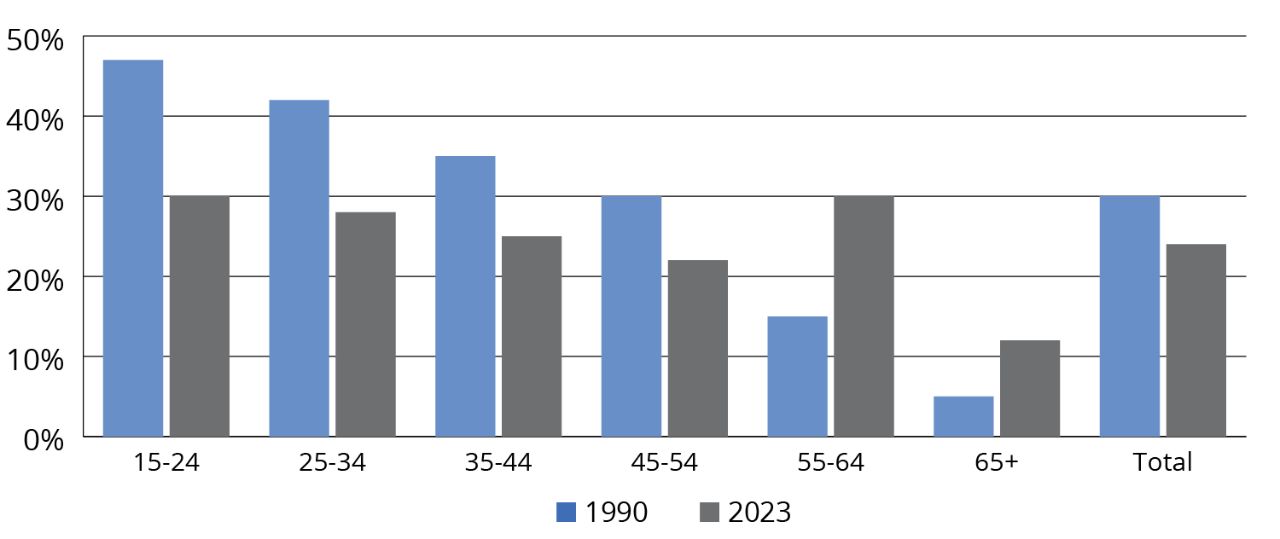

Facing this scenario? You’re certainly not alone. While the overall divorce rate has been stable in recent years, it’s doubled for those 55 to 64 and older since 1990 (FIGURE 1). For those over 65, the rate has risen 140%, particularly for couples in second marriages.1

The potential causes of this so-called “gray divorce” vary. However, what matters most for those exiting marriage is what comes next. While earlier research suggested that approximately 25% of divorces occur later in life, more recent data continues to show a significant rise in divorce rates among adults aged 55 and older.2 Without careful planning, many may be on worse financial footing than their married or widowed peers.

FIGURE 1

The Divorce Rate for Those Age 55+ Has Doubled in the Last Few Decades

Divorce Rates by Age Groups (1990 and 2023)

Sources: Centers for Disease Control and Prevention (CDC), National Center for Health Statistics FactStats, 2023; CDC State Divorce Rates (1990-2023), US Census Bureau, 2023. Most recent data available.

Steps to a Brighter Financial Future

Take the following proactive actions to start your solo financial journey.

1. Make New Investment Decisions

One spouse may have assumed a majority of the financial decisions. If you actively handled things, be proactive and reach out to your financial professional to discuss. If you’re the one who wasn’t part of the conversations, talk with your financial professional to catch up on what you need to know now.

2. Create an Investment Plan for One

Most of the graying divorced have only a fraction of the assets of their married peers. Develop a new strategy to help maintain your goals. Your financial professional may be best equipped to evaluate and help make adjustments.

3. Calculate New Expenses

The monthly expenses you’re responsible for essentially just doubled. If you’re planning to live on a fixed income, those extra expenses need to be factored into a new long-term plan. If you had stopped or planned to stop working, you might have to reevaluate.

4. Get Your Own Insurance

Your old policies included both spouses. It’s time to secure your own individual insurance coverage—whether that be health, life, disability, homeowners, or automobile. Don’t forget to review your beneficiaries, too. Your financial professional can be a great resource to help you determine your needs and refer you to an insurance professional, if necessary.

5. File Your Taxes Separately

Divorcing couples who are still married as of the end of the year are treated as married by the IRS and must determine their filing status (i.e., married filing jointly, married filing separately, etc.). Divorced couples, or those in the process, will also need to consider the tax treatment of alimony or separate maintenance. Contact your tax professional to let them know your situation and to discover the best options.

The Rest of Your Life

The next phase of your life will certainly be different. Planning for this new future sooner rather than later can help ensure you stay on track despite impending changes.

In addition to a lawyer and tax professional, your financial professional can help you navigate through all the decisions. Together, you can work through all of the challenges ahead to turn this new start into the beginning of a better tomorrow.

Talk to your financial professional to help guide you through the important decisions that may follow a late-life split.

1 Centers for Disease Control and Prevention, National Center for Health Statistics: State Divorce Rates, 1990–2023; US Census Bureau, Marital Status by Age and Sex: 2023 American Community Survey 1-Year Estimates.

2 Centers for Disease Control and Prevention. FastStats – Marriage and Divorce. Updated 2023. Most recent data available.

All information provided is for informational and educational purposes only and is not intended to provide investment, tax, accounting or legal advice. As with all matters of an investment, tax, or legal nature, you and your clients should consult with a qualified tax or legal professional regarding your or your client’s specific legal or tax situation, as applicable. The preceding is not intended to be a recommendation or advice.