- Individual Investor? Learn More Individual Investor? LEARN MORE >

-

ACCOUNT ACCESS

- FOR FINANCIAL PROFESSIONALS

- Mutual Fund Accounts

- Smart529 Accounts

- FOR INDIVIDUAL INVESTORS

- Mutual Fund Accounts

- Smart529 Accounts

-

CONTACT US

Pre-Sales Support

Mutual Funds and ETFs - 800-456-7526

Monday-Thursday: 8:00 a.m. – 6:00 p.m. ET

Friday: 8:00 a.m. – 5:00 p.m. ETPost-Sales and Website Support

888-843-7824

Monday-Friday: 9:00 a.m. - 6:00 p.m. ET- PHONE US MAIL US

- ADVISOR LOG IN

-

Products

- INVESTMENT RESOURCES

- Systematic ETFs

- Model-Delivery SMAs

- The Hartford SMART529 College Savings Plan

- VIEW FUNDS BY ASSET CLASS

- Taxable Bond

- Domestic Equity

- International/Global Equity

- Tax Advantaged Bond

- Multi Strategy

-

Insights

- Market Perspectives

- Equity

- Fixed Income

- Global Macro Analysis

- Strategic Beta & ETFs

- Investor Insight

- The Future of Advice

- Navigating Longevity

- Investor Behavior

- See all Investor Insights

- Investment Strategy

- Global Investment Strategist

- Fixed-Income Strategist

- Informed Investor

- Practice Management

- Resources

- About Us

-

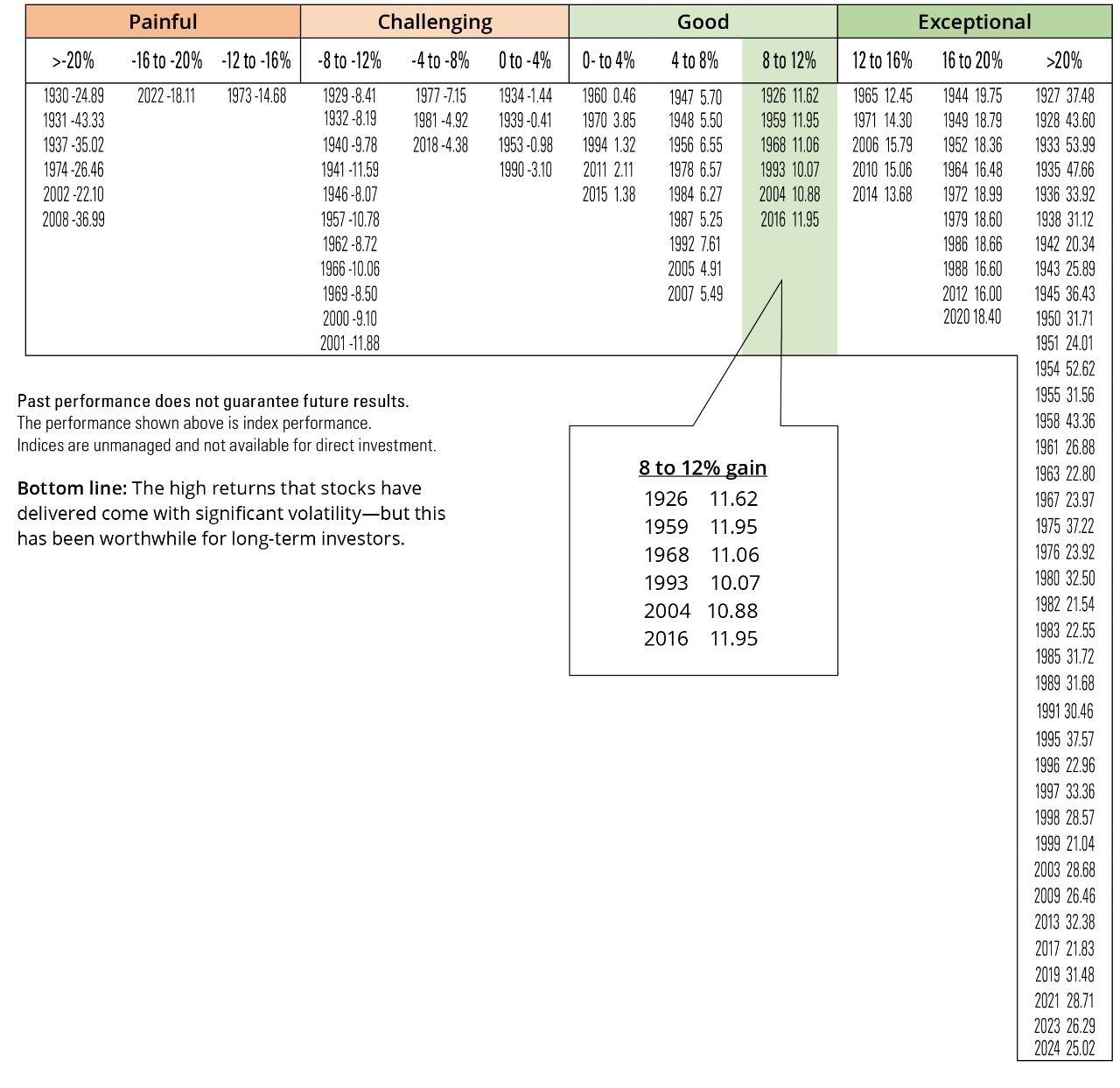

When investors hear that stocks have averaged an annual return of 10.42% since 1926, they may mistakenly believe that stocks will return 10% most years. In reality, stocks have only returned between 8 and 12% in six calendar years since 1926.

S&P 500 Index Annual Total Returns (1926–2024)

Your financial professional can help you stay focused on your long-term goals when you feel impatient with the stock market.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. Returns for the S&P 500 Index from 1926 to 1969 are calculated by Ibbotson and are represented by the SBBI US Large Stock Index. Returns from 1970 to 2024 are for the S&P 500 Index. Source: Morningstar.

Important Risks: Investing involves risk, including the possible loss of principal.